What is Accounting Software?

Accounts receivable, accounts payable, subledger accounting, reporting, and analytics are just a few of the daily financial activities that are managed and recorded by accounting software for a firm. The assets, liabilities, income, and costs of a company are all tracked by a comprehensive accounting system. The general ledger is then updated in real-time as a result of these transactions, giving CFOs, treasurers, and controllers quick access to precise financial data. Additionally, it gives P&L owners access to information on their performance at the operational level.

It is possible to create quarterly and yearly financial statements, including balance sheets, income statements, cash flow statements, and statements of shareholders' equity, thanks to the systematic recording of these financial events. A crucial element of an enterprise resource planning (ERP) system is accounting software.

What Makes for Great Accounting Software

Software for accounting is more than simply a necessary evil. It offers a wide range of functions that might make running your business more efficient. Here are some of the key ways accounting software may help your organization, from generating bills to managing cash flow.

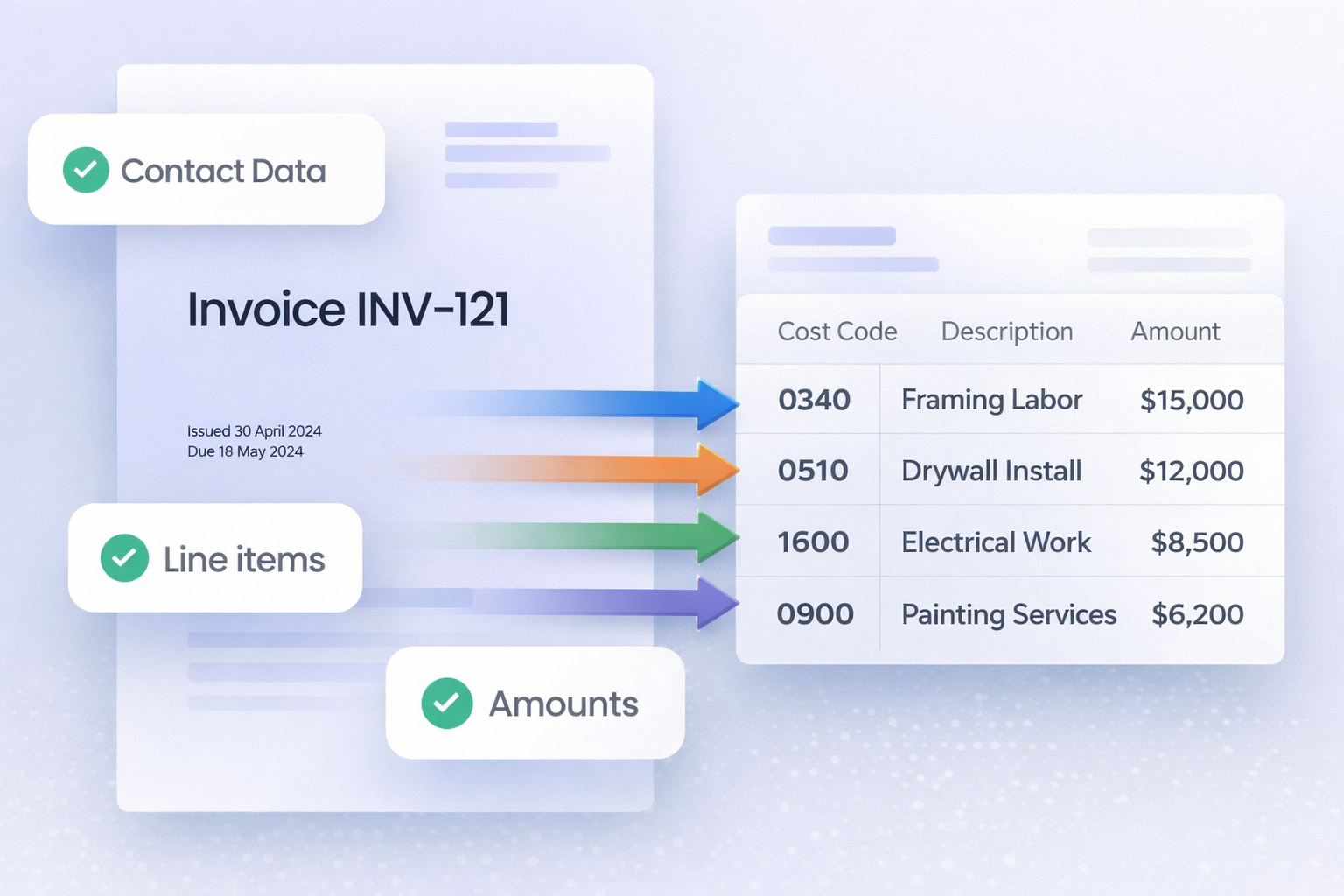

Increase the efficiency of your accounts payable process by automating it using inBuild's smart technology. The outcome? Significant time savings, improved accuracy, and contented team members allow up time to concentrate on other business-related tasks.

Increase your openness

Our software is created to make important business data visible and to improve internal communication. Team members may stay in sync and have access to the data they require whenever they need it by centralizing and automating data collecting.

Keep the Software You Have Now

With the help of our integrations, you may maintain your current procedures while significantly reducing the amount of real physical labor required. Whether it's Quickbooks, Sage, or some other application.

Maintaining Financial Command

One thing is to manage your personal money on the move, but operating a corporation requires something more official. While spreadsheets and pen and paper may work, they won't provide you with the same level of insight as accounting software. Your financial data is organized and kept in one place by accounting software. You may use it to gain a complete picture of your company's financial status in real-time.

Managing Money

Accounting software's cash management features automatically match up cash transactions with bank statements to provide correct cash positions. With automated cash forecasting based on payables, receivables, payroll subledgers, and external transactions, these capabilities also allow businesses to make timely choices about borrowing, investing, and other cash-related activities.

Asset Administration

You can manage the complete asset life cycle, including purchase, capitalization, depreciation, and retirement, with the use of a contemporary accounting system. Having total visibility makes it easier for firms to produce accurate financial accounts for appreciation and depreciation.

Automate Invoice Generation

You must charge clients on time to maintain cash flow and foster business expansion. It could be more difficult to gather if you wait a long time. The top accounting software packages frequently allow you to automate invoicing. You may send follow-up reminders, establish recurring invoices, and take digital payments right from the invoices themselves. You may keep tabs on your outstanding bills and give discounts for payments received early.

Sync Up Your Bank Statements

Connecting to your bank accounts is a key aspect of accounting software. It allows you to instantly view your bank statements from your accounting program. Additionally, you may automatically compare and reconcile bank transactions.

Risk Control and Adherence

Accounting software that includes security, risk management, and audit controls as standard features is an organization's greatest line of defense against fraud and unauthorized user access. Separation of duties (SoD) and internal controls help you adhere to Sarbanes-Oxley (SOX) laws and provide your company with a safe, single source of truth for data.

Fiscal Management

Accounting software with integrated revenue management features automates the process of applying analytics to increase revenue and profitability.

Key Advantages of inBuild

Uphold authority

While you keep ultimate control over permissions, invoice evaluations, and final approvals, we handle the tiresome aspects of accounts payable.

Anywhere access

Our mobile-friendly cloud-based approval tool makes it easy to examine and approve invoices from any location.

Customizations

The platform may be entirely customized to match the unique requirements of your company. We collaborate closely with your team to build up the ideal inBuild configuration for you.

Industry-Leading Service & Support

Our team is here to make sure you receive all you want from our software and more, so you can manage your company as efficiently as possible.

Adaptive Onboarding

We are dedicated to providing a smooth onboarding process along with top-notch continuing customer care and support.

If you're interested in making the switch to inBuild, please don't hesitate to schedule a demo from our amazing team. Find out if inBuild is the solution you've been waiting for!